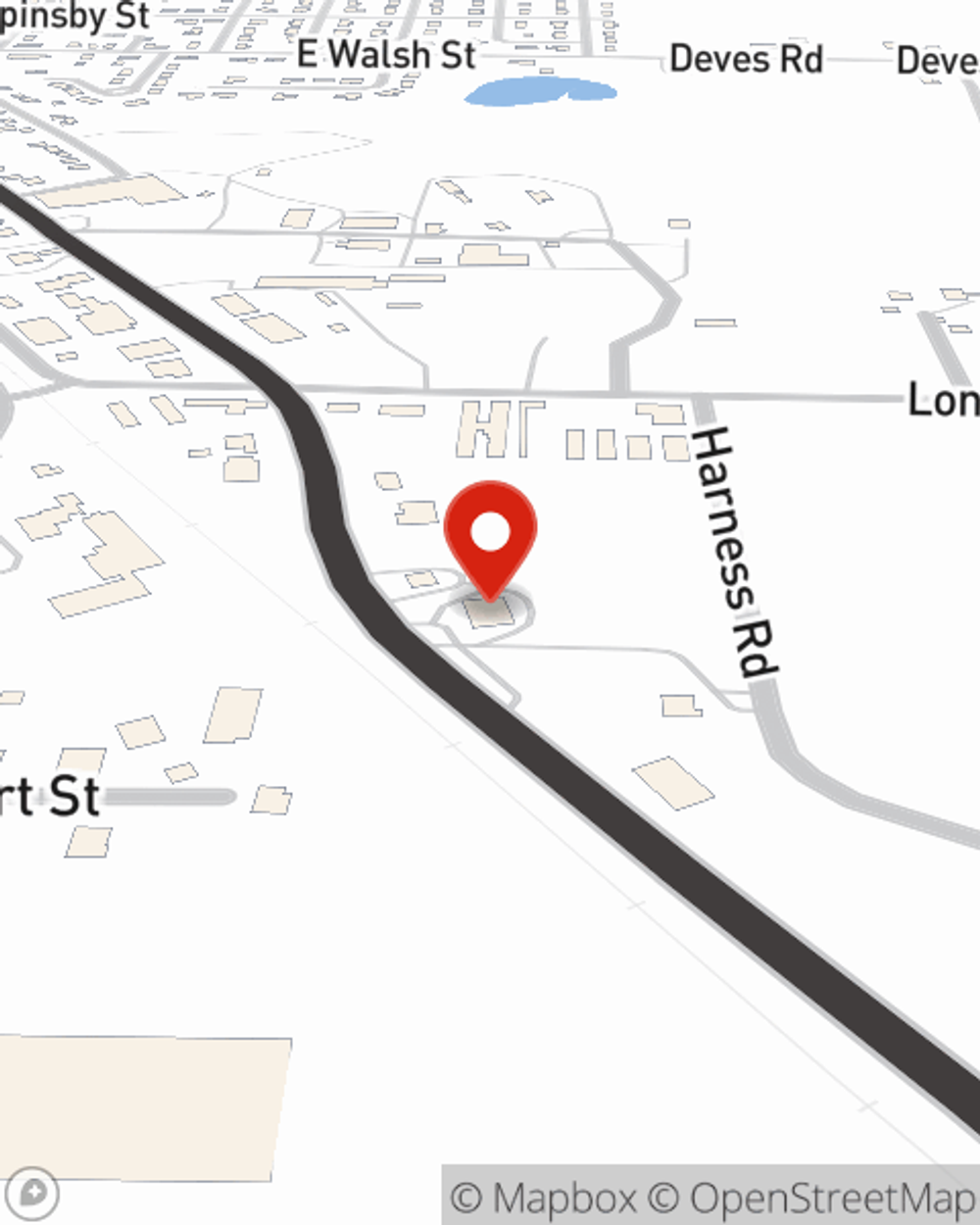

Business Insurance in and around Montgomery City

Montgomery City! Look no further for small business insurance.

This small business insurance is not risky

Your Search For Reliable Small Business Insurance Ends Now.

Small business owners like you have a lot on your plate. From tech support to marketing guru, you do everything you can each day to make your business a success. Are you a dog groomer, a real estate agent or a podiatrist? Do you own a craft store, a pottery shop or a photography business? Whatever you do, State Farm may have small business insurance to cover it.

Montgomery City! Look no further for small business insurance.

This small business insurance is not risky

Small Business Insurance You Can Count On

The passion you have to serve your customers is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Jeff Porter. With an agent like Jeff Porter, your coverage can include great options, such as commercial liability umbrella policies, artisan and service contractors and commercial auto.

Since 1935, State Farm has helped small businesses manage risk. Call or email agent Jeff Porter's team to review the options specifically available to you!

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Jeff Porter

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.